An important note on this template

This resource includes helpful information on why a gift agreement can be necessary and important, and how to get started with one. The section below titled “*Gift Agreement Template” includes a templated gift agreement modeled from one created by Community Foundation of Collier County.

It is up to your organization to take this template and customize it to your own needs and purposes. The resources provided on this page should help you get started with making the template your own.

Resources used in this template

- Philanthropy Works – Gift Agreement

- Philanthropy Works – Leadership Gift Agreements

- Community Foundation of Collier County

- ConservationTools.org, administered by the Pennsylvania Land Trust Association

- Lynne Wester, Donor Relations Guru

- Adam Scott Goldberg, Florida Bar Journal

- George E. Constantine Cynthia (Cindy) M. Lewin Yosef Ziffer Andrew L. Steinberg, Venable LLP

Sample gift agreements provided by the Association of Donor Relations Professionals and Tulsa County.

What is a gift agreement and why do you need it?

“A donation [or gift] agreement may be used to ensure that a donor’s promise can be relied upon, set the expectations of both donor and donee, and prevent misunderstandings.”

– ConservationTools.org, Pennsylvania Land Trust Association

A gift or donation agreement, not to be confused with a gift acceptance policy, are expressly for the purpose of spelling out and documenting what the donor expects and what the nonprofit is committed to providing. Any gift that reaches the major gift status defined by your organization should require a gift agreement, even at the monthly gift level. A thorough gift agreement can ensure that your nonprofit and the donor are on the same page and agree with the various aspects of the major gift. Gift agreements are completed and signed to prevent misunderstandings, and show your donor that you care and that they are valued and important.

As a nonprofit organization must keep accurate records on donations received, so must a donor keep records of donations they’ve made — especially when it comes to tax time. Having an accurate gift agreement and other financial records on file will help keep the nonprofit and the donor on the same page.

Goals of your written gift agreement

According to the Pennsylvania Land Trust Association, a written agreement is needed for:

- a donation subject to restrictions that allow the donor control over the future use of the donation

- a donation to be held, invested or disbursed pursuant to certain agreed-upon terms

- a donation that will result in naming a property or project after the donor

Some other questions and points from Philanthropy Works to consider when drafting your formal, written agreement:

- Can the nonprofit manage the gift within the proposed restrictions in a cost-effective manner consistent with the mission of the nonprofit?

- Is the nonprofit willing to accept the asset which is being proposed to fund the gift?

- How will the nonprofit account for the gift?

- What reports will be provided to the donor or the donor’s family/designates about the organization’s use of the gift?

- What recognition of the gift should be given to the donor?

- Are there expectations (do not agree to restrictions) on the nonprofit’s investment of the donated property?

- After the donor is no longer involved, who may later modify the donor’s restrictions?

- This might be on the extreme end, but you could include a clause identifying who, if anyone, has standing to bring suit.

- “Sunset” clauses are highly recommended for consideration (set an end date for the fund).

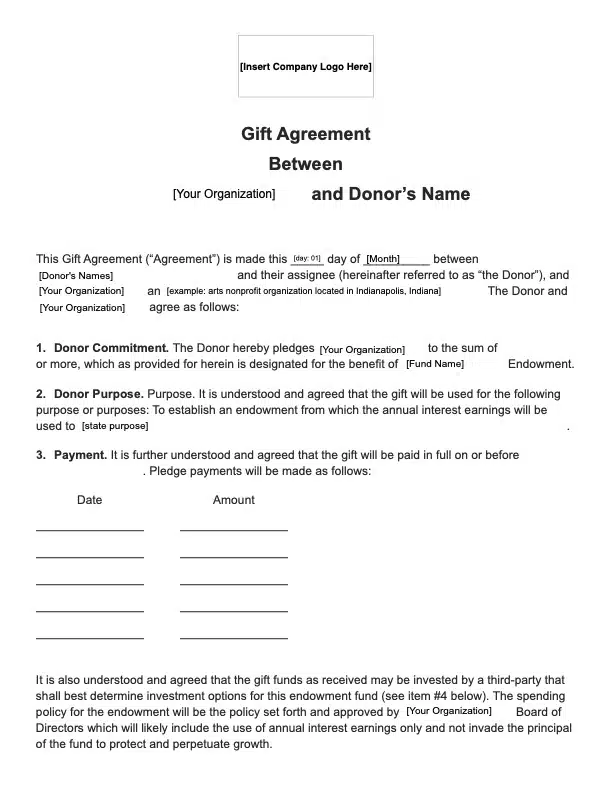

Sample Gift Agreement

Check out a sample gift agreement example for The University of Alabama at Birmingham provided by the Association of Donor Relations Professionals here.

Here’s a sample gift agreement for real estate property created by Tulsa County.

What is a morality clause and why should you include one? What does it look like in your gift agreement?

A morality clause or morals clause is a small, but important segment to add to your gift agreements. A morality clause is used to define particular circumstances that would be embarrassing or harmful to an organization’s reputation and values. According to Lynne Wester, nonprofits must protect their organizations from undue risk. Most nonprofits depend on public goodwill to attract donors. Close association with someone whose name has been badly tarnished can taint the nonprofit’s reputation and harm its ability to attract support.

Here is some sample language from Lynne Wester at Donor Relations Guru for you to have reviewed by your general counsel and then have in place in your gift agreement:

If at any time the donor or his or her name may compromise the public trust or the reputation of the institution, including acts of moral turpitude, the institution with the approval of the board of trustees has the right to remove the name or return the gift.

*This was also included in section 11 of the gift agreement template above.

Here’s another sample morality clause from Adam Scott Goldberg at the Florida Bar Journal:

If at any time the donor fails to conduct himself or herself without due regard to public morals and decency, or if the donor commits any act or becomes involved in any situation, or occurrence tending to degrade the donor in the community, or which brings the donor into public contempt or scandal, or which materially and adversely affects the reputation or business of the charity, whether or not information in regard thereto becomes public, the charity shall have the right to remove donor’s recognition rights as required pursuant to this gift agreement.

Other resources to help you get started creating a gift agreement

ConservationTools.org administered by the Pennsylvania Land Trust Association was very thorough in creating a helpful donation agreement guide from a conservation organization perspective. You can check it out here.

Philanthropy Works published a piece on getting started with a gift agreement geared towards a department leadership perspective. Read it here.

AICPA.org’s piece, here, dives into considerations in negotiating and drafting gift agreements.